Mastering the Market: Buy and Sell Silver Like a Pro

In the world of precious metals, silver stands out as a versatile and attractive investment opportunity. Its unique properties make it a favorite among collectors and investors alike. If you’re considering investing in silver, understanding how to buy and sell silver effectively is crucial to maximizing your potential returns. This comprehensive guide will delve into various aspects of the silver market, offering you valuable insights and actionable strategies.

Understanding Silver as an Investment

Silver, often referred to as the "poor man's gold," is more than just a metallic element. Unlike many assets, silver has various industrial applications, ranging from electronics to photography. This unique position not only adds diversity to its market but also creates opportunities for investment.

The Historical Context of Silver Investment

Historically, silver has been used as a form of currency and a store of value. Over the ages, societies have valued silver for its intrinsic properties. Even today, its demand persists, not just as a financial asset but in:

- Industrial Uses: Silver is utilized in industries such as electronics, solar energy, and medical applications.

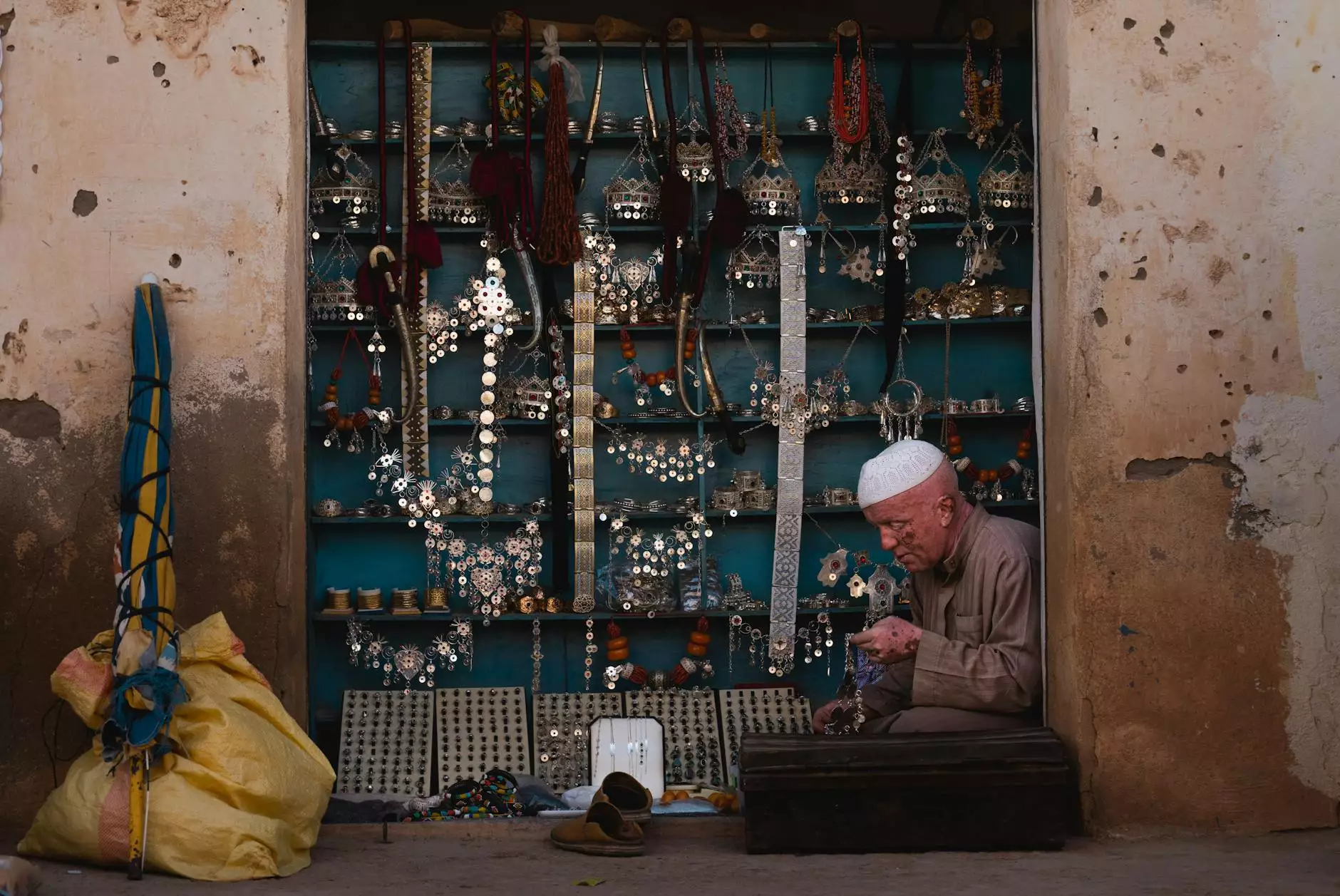

- Jewelry and Fashion: The allure of silver in the jewelry industry adds to its demand.

- Collectibles: Coins and bullion attract collectors, adding another layer to its market.

Why Invest in Silver?

Investing in silver can be a rewarding venture for several reasons:

- Diversification: Silver serves as an excellent portfolio diversifier, mitigating risk during turbulent economic times.

- Inflation Hedge: Like gold, silver has historically been used as a hedge against inflation, preserving purchasing power.

- Growing Demand: As industries expand, the demand for silver is expected to grow, potentially increasing its value over time.

How to Buy Silver

When it comes to buying silver, various options are available to suit different investment strategies. Before you dive into the purchasing process, keep the following in mind:

1. Determine Your Investment Goals

Understanding your investment goals is the first step. Are you looking to invest for short-term gains, or are you considering silver as a long-term asset for wealth preservation? Your strategy will dictate the types of silver products you should consider:

- Coins: Government-issued coins, such as American Silver Eagles or Canadian Silver Maple Leafs, are popular among investors for their purity and market recognition.

- Bullion: Silver bars and ingots are available in various sizes and are typically sold at lower premiums than coins.

- Silver ETFs: Exchange-traded funds allow investors to gain exposure to silver without the need for physical storage.

2. Research Reliable Suppliers

Identifying trustworthy dealers is critical when you decide to buy and sell silver. Look for suppliers with:

- Reputation: Check online reviews, ratings, and the dealer's standing in the industry.

- Transparency: A reputable dealer will offer transparent pricing and provide thorough information about their products.

- Customer Service: Effective communication and assistance are key indicators of a reliable dealer.

3. Understand Pricing

The price of silver is subject to market fluctuations based on supply and demand dynamics. Here’s what to consider:

- Spot Price: This is the current market price for silver and will serve as the baseline for your purchases.

- Premiums: Dealers may charge a premium over the spot price, which varies based on the product type and market conditions.

- Trends: Familiarize yourself with past price trends to better predict future movements.

Where to Buy Silver

Silver can be purchased from a variety of sources:

- Online Retailers: Websites like donsbullion.com offer a wide selection of silver products, often at competitive prices.

- Local Coin Shops: Visiting a local dealer can provide personal interaction and immediate product access.

- Pawn Shops: Sometimes, pawn shops offer silver items at lower prices, though it’s essential to do thorough assessments.

- Private Sellers: Be cautious with private sales; ensure proper verification and authentication of products.

How to Sell Silver

When the time comes to liquidate your silver holdings, you’ll want to maximize your profits. Here are some essential steps for successfully selling silver:

1. Assess Your Silver Accurately

Before selling, ensure you know the quality and quantity of your silver:

- Purity: Silver quality is measured in purity, with 0.999 being the purest form.

- Weight: Accurately weigh your silver to calculate its market value.

- Condition: The condition of coins or bars can impact their resale value.

2. Choose the Right Time to Sell

Timing your sale can greatly influence your return. Monitor market conditions and try to sell during price peaks. Additionally, consider:

- Market Trends: Stay updated on economic indicators and industry news that may impact silver prices.

- Seasonal Trends: Certain times of the year may see increased demand, such as before holiday seasons.

3. Select the Best Selling Channel

Similar to buying, various selling channels can affect your transaction. Options include:

- Online Auctions: Platforms such as eBay can help reach a wide audience but may incur seller fees.

- Dealers: Selling to reputable dealers may offer convenience. Ensure you compare offers from multiple dealers to get the best price.

- Local Coin Shows: Attending coin shows can help connect sellers with buyers directly, often leading to better offers.

Tax Implications of Buying and Selling Silver

It's vital to be aware of the tax implications when you buy and sell silver. In many jurisdictions, precious metal sales are taxed, affecting your net gains. Here are the key points to consider:

- Capital Gains Tax: Profits from selling silver may be subject to capital gains tax, depending on how long you’ve held the asset.

- Record Keeping: Maintain accurate records of your purchases and sales for tax purposes.

- Consult a Tax Professional: Consulting with a tax expert can help clarify any complex situations surrounding precious metal investments.

Conclusion

Investing in silver can be a wise decision, providing opportunities for both wealth preservation and profit generation. Understanding the nuances of how to buy and sell silver is crucial for any investor. By following the steps outlined in this guide, you can position yourself for success in the precious metals market.

Make informed decisions, research diligently, and stay updated on market trends to make the most of your silver investments. Keep exploring the world of precious metals and consider reputable dealers, such as donsbullion.com, to facilitate your silver trading journey.